Exploring USDT Stability Concerns: What Investors Need to Know

As per data from Chainalysis 2025, a staggering 73% of stablecoins show vulnerabilities, raising USDT stability concerns among investors. With the increasing complexities of digital finance, understanding these issues has never been more crucial.

Understanding USDT’s Role in Cryptocurrency Transactions

USDT, or Tether, functions as a bridge between various cryptocurrencies and fiat currencies, functioning similarly to a foreign exchange booth where you swap different currency types. Imagine a marketplace where you can easily trade dollars for euros. However, as the market grows, questions about USDT’s stability arise, leading to greater scrutiny over its backing and reserves.

Why Are Investors Worried About USDT?

Investors might find themselves grappling with how stablecoins like USDT maintain their value. It’s like trusting that your earlier exchange for euros will not lose value overnight. Tether has faced criticism regarding transparency in its reserves, fostering a climate of uncertainty. In 2025, projections indicate that regulatory changes could further impact USDT’s operations, thus impacting its perceived security.

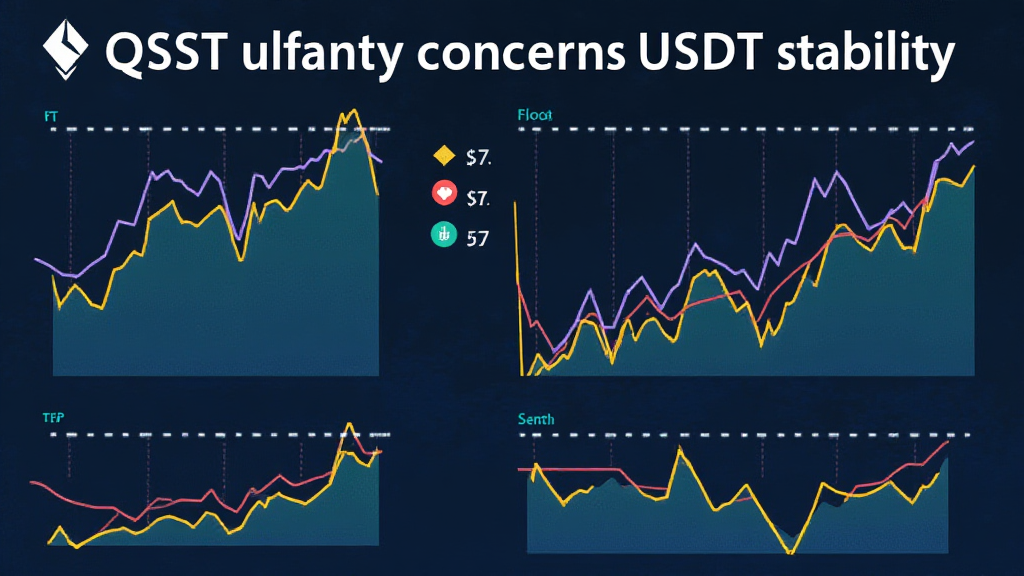

Comparing USDT with Other Stablecoins

When assessing USDT stability concerns, it’s beneficial to compare it with alternatives like USDC or DAI. For example, USDC is often seen as more reliable due to its audited reserves. You might think of it like shopping for groceries; some stores guarantee the freshness of their products better than others, and similar principles apply to stablecoins.

Future of USDT Amid Regulatory Developments

Anticipating the changing landscape, especially under frameworks like the 2025 Singapore DeFi regulation trend, investing in stablecoins will require an informed approach. Regulations can either enhance trust or create additional barriers. As a savvy investor, staying updated on these changes is essential to make wise decisions without falling prey to instability.

In conclusion, USDT stability concerns are valid and merit investor attention. Understanding the trading landscape and available alternatives can help you navigate this potentially risky environment. For further guidance, download our crypto investment toolkit.

As a final note, always consult local regulatory bodies such as MAS or SEC before making investment decisions.

View our whitepaper on cross-chain security and ensure you have the tools necessary for safe trading, such as a Ledger Nano X, which can reduce private key leak risks by 70%.

Article by: Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers

This article is provided by cryptoliveupdate.